Abstract¶

The business world is full of startup stories and legends but they’re not focused on businesses in the wood products industry. Starting a wood products business in California is exceptionally challenging given the lack of infrastructure, permitting, and difficulty in obtaining long-term (>3 years) feedstock contracts from government agencies such as the Forest Service. Funding and finance is challenging given lack of lender expertise in the field and investors wanting returns on a shorter time period. We offer lessons and approaches for new businesses negotiating this challenging environment along with funding and non-funding resources that can pave the way to success.

Takeaways¶

Business plan. Develop a clear business plan with a vision, achievable objectives, scalable expansion, and brief, but accurate, finance plan.

Networking. Network across professional in the field to see their approaches, how they’ve solved problems, and develop and possible partnerships.

Compliance. Start and CEQA/NEPA compliance early and budget properly for the documents and permits you need to get that first spade in the ground.

Feedstock agreements. Make sure to secure long-term feedstock agreements from the landowner where your wood is sourced. It can be exceptionally difficult to arrange terms longer than three years with public agencies, so the earlier you start, the better. For more detail on this topic and potential solutions, see Russell (2025).

Funding. This is the big one, and the most challenging. However, if you organize your plans, your pitch deck, and your business idea is good and fills a key need, the funding will come. Don’t confuse funding and finance, they’re two very different things, but you need to do both. There are many options for collaborative finance in the forestry and water worlds Russell & Odefey, 2024.

Introduction¶

Describe the key differences in program design vs. feasibility and viable project design (Regine email)

Challenges¶

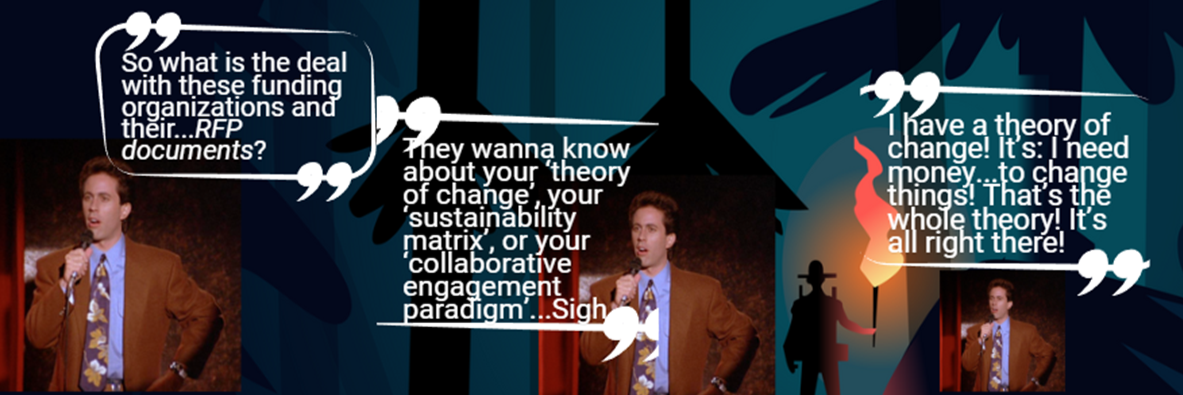

We often go straight to funding when it comes to challenges and one of the biggest challenges can be unreasonable requests for RFPs from funding agencies (Figure 1). Yes, you do have something that is going to change the world. So why isn’t everyone funding it? Maybe you don’t have a theory of change!

Figure 1:Seinfeld’s thoughts on funding agencies.

Other challenges include the following:

Lean funding & finance opportunities. Many grant opportunities are geared towards nonprofits. CAL FIRE’s Business and Workforce Development Grants and USFS’s Wood Innovations Grants are some of the few that offer busineses the opportunity to apply for public funds.

Lack of infrastructure.

Inability to facilitate long-term feedstock agreements. Swezy (2025) mentions that once the sawlog supply normalized following the Dixie Fire, that although the regional Forest Service leadership is trying to align with the Wildfire and Forest Resilience Task Force Action Plan for treatment targets, these objectives do not often match the local district ranger capacity to secure feedstock contracts nor the funding for the work resulting in inconsistent log supplies and financial instability for wood processing facilities.

Lack of resources bespoke to wood products businesses.

Sparse networking and partner opportunities.

Leadership to run wood processing facilities. Although experienced labor to run mills may be available, as has been the case for Tahoe Forest Products and J&C Lumber finding skilled leadership for supervisory positions to support operations and grow startups may be difficult Swezy, 2025.

Recommendations to Funders

Other main startup challenge: coming up with your own money to fund the project. CAL FIRE program comes in here

Putting together proposals in response to foundations and government agency requests for proposals (RFPs) can often be an arduous or torturous process. It doesn’t have to be this way, and some foundations and agencies are much better at it than others. They vary so widely it’s hard to make generalizations, but the best pay more attention to process and capacity building. Here are our suggestions for funders:

Streamline the initial application process. One page: tasks, budget, qualifications. That’s it! Details later! Don’t make grantees answer 17 questions and develop a 50 page proposal for funding they may have a small change of securing. That’s not fair to them or reviewers.

Consider participatory grant-making. What if we flattened the decision-making for who gets funding and included grantees in that process. What if grantmaking by all funders was more transparent and less opaque? Maybe this would require more time up front by funders, but it could lead to stronger projects and improved connections to grantees.

Rethink proposal forms. Consider providing templates in word or pdf format that grantees can fill out then upload the saved docs to your grant portal instead of using online forms that require filling out each section before moving on to the next. No one should have to cut and paste their proposal to submit it online; that is so 1990s. Look for others ways to automate this process with grantees.

Shorten RFPs. RFPS in excess of 20 pages make it difficult for grantees to get to translate to proposals. List what you want, how much to apply for, and leave the legalese for funding recipients, e.g., don’t include pages of appendices with contracts and required forms. The legal documentation can have a link online and providing other key documents, e.g., model budget or scope could be made available.

Set realistic due dates. Not January 2 or the week after Thanksgiving or even during the summer school holidays. Also don’t release RFPs on December 23rd, that’s verging on Ebenezer Scrooge behavior. These due dates aren’t made up, we have experienced this for grants and heard from partners about the same.

Simple solutions¶

There are some solutions that seem obvious and are simple, but many businesses don’t take them seriously. The first example is writing a clear, compelling, and readable business plan. Don’t use ChatGPT to write this. This isn’t a joke, FBA has reviewed some business plans that were probably written by ChatGPT. For immediate impact, these could include:

Theory of change

Business plan.

Measuring success plan.

Advanced solutions¶

After simple solutions, there are solutions that will be more difficult to attain or implement, but are worth the effort. These could include things like an equitable staffing structure, ramping up finance rounds beyond startup stage, and realistically costing out how your business is going to scale.

Staffing

Finance 202

Scaling

Project pathway¶

discuss the development pathway/stages/steps, the types of expertise that are needed to support a project achieving these steps, common pitfalls or hurdles, example projects/case studies, grant funding opportunities to support project development, free TA resources, etc. I don’t think we should dive into pitch decks and success monitoring because these are associated with late stage development.

I. Back-of-the-envelope¶

Spitballing stage for the initial ideas that precedes the pre-concept.

II. Pre-concept¶

Establishing a vision and project concept, goals and objectives

Identification of technology options and preferred option

Site and infrastructure evaluation

Feedstock volume and pricing assessment

Identification of the permitting pathway

High level financial analysis (capex, opex, potential sources of capital, market demand/pricing, sensitivities)

Partner mapping/initial engagement

Establishing a preliminary project schedule

III. Feasiblity¶

Cite Featherman (2025) here? See bib for url link to study

Securing site control

Preliminary engineering and design for the preferred tech, and a third party review of it

Detailed financial analysis

Establishing the appropriate business structure

Further feedstock and market analyses, if needed

Securing feedstock supply letters of intent/contracts

Securing offtake letters of intent/contracts

Identification and initial pursuit of capital stack

Refine and maintain the Gantt

Partner/stakeholder engagement

IV. Consolidation? (Late Stage)¶

Final engineering/design

Construction and operating permits

Complete lender/investor requirements and financial close

Establish construction schedule and plan

Procure long-lead equipment

Pitch deck

V. Implementation Up & running¶

VI. Stock taking¶

Resources¶

From the Biomass newsletter sent from Martin on Nov 25, 2025:

Wood Products Campus Siting and Financial Risk Analysis. As part of the South Central Sierra feedstock aggregation pilot project (https://

LCI feedstock pilots: https://

- Russell, V. (2025). JPA funding strategies: For long-term woody feedstock supply agreements in California. 3point.xyz. https://3point.xyz/neca_jpa/

- Russell, V., & Odefey, J. (2024). Conservation finance: Towards a new model for landscape restoration. 3point.xyz. https://confinance.info

- Swezy, C. (2025). A case study of J&C Lumber: Successes, challenges, and lessons learned in launching a small-scale sawmill for wildlfire recovery. CALFIRE Business. https://calfire-umb05.azurewebsites.net/media/1pygldxy/j-c-lumber-case-study_january-2025-final-report.pdf

- Featherman, D. (2025). South Central Sierra pilot study: Wood products campus siting and financial risk analysis. Wildephor Consulting Services, LLC. https://californiaforestproducts.org/wp-content/uploads/2025/11/SCS_SitingandFinancialRiskAnalysis_20250831.pdf