Abstract¶

Western U.S. forests have accumulated undergrowth and small‑diameter trees due to past fire suppression and management, increasing wildfire intensity, tree mortality, and carbon emissions while producing large volumes of low‑value chips that are costly to remove. Simultaneously, the horticulture industry depends on peat moss mining—a practice that degrades peatlands, releases stored carbon, and faces growing supply volatility—creating an urgent need for substrate alternatives. Plumas Wood Fiber will convert chips from fuels‑reduction and restoration projects into a substitute or supplement for peat that replicates peat’s drainage, aeration, and moisture‑retention properties. University lab testing and ongoing pilot growth trials with ~20 nurseries and research partners seek to demonstrate technical feasibility and generate buyer interest. The company’s business model links feedstock procurement to forest restoration, shortens transport distances, and reduces delivered carbon intensity. Scaling for commercial production requires purpose‑built extrusion, automated baling, and strategic co‑location with a biomass energy plant to lower capital and energy costs. Key risks include feedstock variability, capital intensity, permitting, conservative buyer adoption, and dependence on blended financing; mitigation focuses on replicated trials, offtake agreements, and multi‑source capital. At scale, a single facility could use thousands of bone‑dry tons annually, support wildfire mitigation financing, create local jobs, and provide a regional, lower‑carbon alternative to peat.

1.1Takeaways¶

Addresses multiple problems. Simultaneously addressing societal/environmental problems and industry needs makes for a compelling case to governments, grantmakers, and impact investors.

Importance of grants & partnerships. Grants and partnerships are essential to offset business risk, especially when resources are constrained.

Connection to research. Strong academic collaboration and rigorous lab testing are necessary to validate product performance.

Broad outreach. Broad outreach and participatory validation help to generate interest and move potential buyers from curiosity to commitment.

Scaling. Careful planning—such as partnering with energy providers and securing early buyer commitments—helps reduce financial risk and stabilize cash flow when scaling from pilot to commercial production.

1.2Context¶

For decades, western U.S. forests have accumulated undergrowth and small-diameter trees because of fire suppression and past management practices. That accumulation increases wildfire intensity, killing trees and releasing large pools of stored carbon. At a larger scale, this is contributing to ecosystem destruction. Removing that excess biomass is expensive and often produces large volumes of chips with little commercial value.

At the same time, the horticulture industry relies on vast quantities of potting substrate, historically supplied by peat moss harvested from peatlands, which destroys peatland ecosystems and their carbon stores. Peat moss harvest also releases large amounts of greenhouse gases, degrades biodiversity, and causes long‑term habitat loss. Additionally, logistical challenges and climate impacts have disrupted summer peat harvests in Canada—for example, yields fell by 25–50% in 2023—producing wide swings in peat price and availability; this volatility is a major concern for the horticulture industry, which expects to double or quadruple its use of potting substrates in the coming decades.

Plumas Wood Fiber emerged at the intersection of these trends. The company sees market demand from California’s growers and substrate blenders for a locally sourced substitute that matches peat’s horticultural performance while avoiding peat’s environmental and supply-chain drawbacks. Early analytical work with academic partners and funding from the Conservation X Labs Fire Grand Challenge pilot allowed Plumas Wood Fiber to explore whether western conifer species can meet the physical properties required for potting mixes. The preliminary results and stakeholder interest signaled a viable market and a compelling circular solution: chip material from hazardous fuels-reduction projects converted into a valuable horticultural input that reduces transport emissions and helps finance forest treatments (Figure 1.1).

Figure 1.1:Sample wood fiber substrate produced by Plumas Wood Fiber.

1.3Business model¶

Plumas Wood Fiber’s business model ties feedstock procurement directly to forest restoration activity. The company will source wood chips from contractors performing fuels-reduction and restoration work on federal and private lands, and purchase chips at prevailing market rates to ensure a steady supply.

The company’s value proposition rests on three connected advantages:

Feedstock. Ready access to low‑cost feedstock from wildfire fuels‑reduction projects;

Transportation. Much shorter transport distances to West Coast horticultural buyers compared with imported peat, and

Performance. Validated substrate performance for a range of food crops and ornamental plants.

These factors combine to lower delivered cost and greenhouse‑gas footprint while meeting the technical requirements buyers expect.

Plumas Wood Fiber is moving deliberately from pilot validation toward commercial scale. The pilot phase used grant funding to produce hammer‑milled fiber in partnership with Real Good Soil and distribute samples to roughly twenty horticultural stakeholders and academic partners for growth trials. Those trials, together with lab testing led by a university horticultural substrates lab, form the evidence base required to convince large buyers to adopt a new substrate.

Figure 1.2:Plumas Wood Fiber using a hammer mill to produce sample substrate for growth trials.

In the pilot phase, Plumas Wood Fiber used hammer‑milling (Figure 1.2) to produce sample fiber for growth trials (Figure 1.3). Operational scaling requires a purpose-built site and specialized equipment, including twin‑screw extruders and automated baling lines that convert chips into an engineered fiber that mimics the drainage, aeration, and moisture-retention characteristics of peat (Figure 1.4).

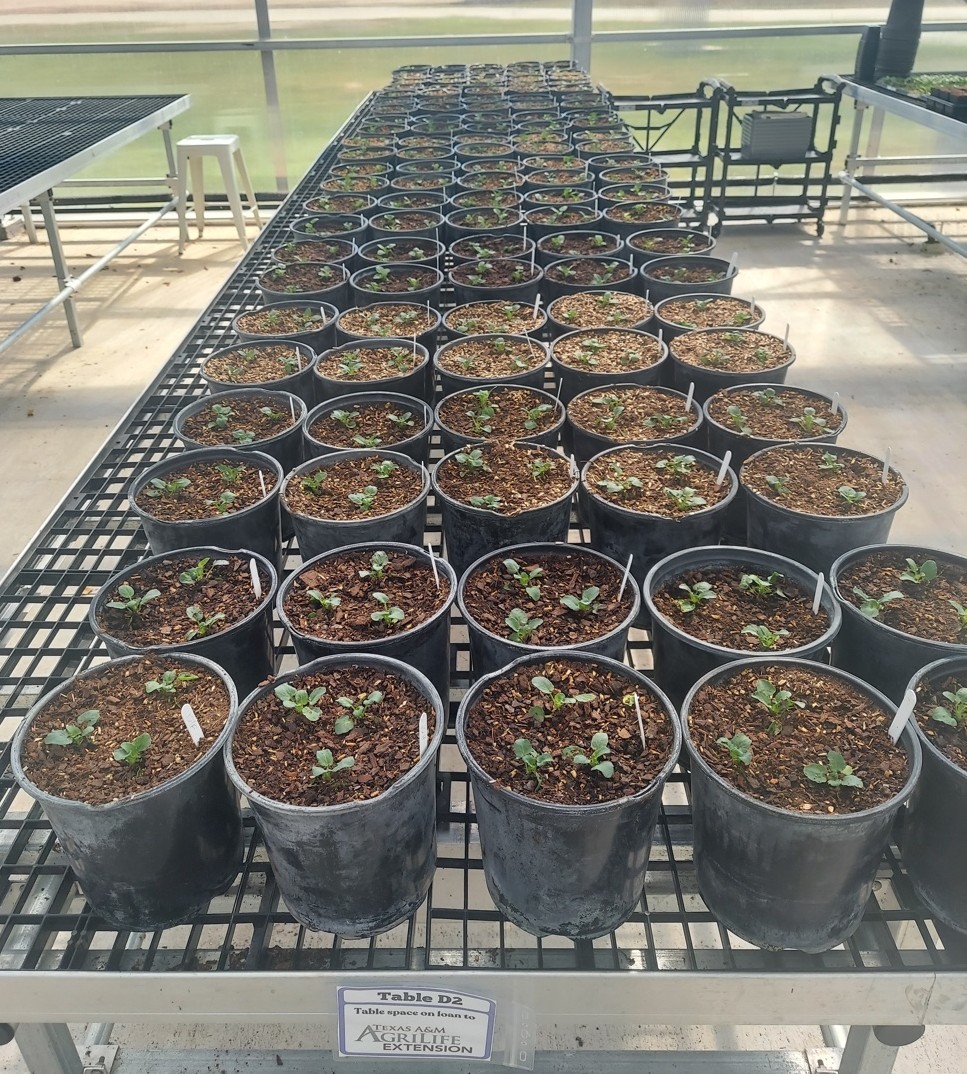

Figure 1.3:Growth trials at Texas A&M University. Credit: Paul Winski.

In addition to extruders, production lines, and robotic baling and palletizing, commercial production requires a large chip-receiving yard and material-handling equipment. To reduce capital and operational expenses, the company is planning to co-locate its production facility with a biomass energy generation plant to be installed in Quincy, California, by West Biofuels of Woodland, California.

Figure 1.4:Fiber extruder at a wood fiber substrate production facility in Amsterdam. Plumas Wood Fiber’s facility will include a similar production line.

Once large-scale production begins, Plumas Wood Fiber will target commercial nurseries and potting‑mix blenders that buy substrate by the truckload, and it will also offer palletized bales for broader distribution to regional blenders and retail mix producers. The company projects a Freight on Board sale price near $20 per cubic yard, producing delivered costs competitive with out-of-state wood-fiber suppliers once transport is included.

1.4Startup¶

Plumas Wood Fiber’s pathway to success is not without risk. Operationally, feedstock variability—moisture, particle size, seasonal availability—and the high capital intensity of extruder machinery raise the risk of production interruptions and cost overruns. Market adoption remains uncertain and will be shaped by the outcomes of growth trials, which are critical to overcoming conservative buyer hesitancy. At the same time, competitive pressure from established wood‑fiber suppliers and lower‑cost peat/coir blends could depress pricing and slow uptake, underscoring the importance of trial success in mitigating market risk. Regulatory and policy risk exists in multiple forms: changes in fuels program funding could shrink chip volumes; permitting for a processing facility can introduce delays or unexpected costs; and potential shifts in environmental policy—positive or negative—could alter incentives for peat displacement or biomass utilization. Finally, the business depends on a blended capital stack of grants, concessional loans, and commercial finance to bridge capex, so reduced grant availability or loan delays could postpone commercialization.

Nevertheless, if the validation work and early commercial runs confirm product performance at scale, Plumas Wood Fiber has clear expansion pathways. The model is replicable in other western forest regions with similar fuel treatment byproducts, enabling a distributed network of mid‑sized facilities that feed regional horticultural markets. Product innovation could lead to proprietary blends tailored to specific crops, bagged retail products for consumer markets, or preconditioned fibers designed for large greenhouse operations. Technological improvements—especially gains in extruder energy efficiency and automation in baling and loading—would materially improve margins. Strategic partnerships with large offtakers, soil-blend manufacturers, and impact investors seeking wildfire- and carbon-positive projects could secure long-term revenue streams and flexible capital. Support in the form of grants or incentives that internalize the costs of forest restoration and carbon co-benefits could accelerate growth.

The horticultural industry is projected to significantly expand its use of substrates in the coming decades, with overall demand expected to double or even quadruple. Within that growth, wood fiber substrates are anticipated to see a tenfold increase in adoption—marking this as a high-potential sector where innovative start-ups are well-positioned to lead. However, establishing a viable industry for producing wood fiber substrate from Western forest biomass represents a novel approach for both forestry and horticulture. As a result, both sectors are currently adopting a cautious, wait-and-see stance.

Biomass enterprises inherently operate on tight margins due to the nature of the material—high volume, low value—and the logistical complexity of sourcing it. Building a viable business under these conditions demands careful planning, operational efficiency, sound partnerships, and strategic coordination. If Plumas Wood Fiber proves successful, it could unlock new opportunities for climate-smart forest management and sustainable horticultural supply chains. If not, it may dampen investor confidence and constrain future efforts to develop alternative biomass-based products. The stakes are high—but so is the opportunity.

1.5Partnerships¶

Partnerships are central to Plumas Wood Fiber’s strategy, providing technical validation, feedstock access, pilot capacity, and financing pathways that together de‑risk scaling and accelerate market entry. On the research front, the company partnered with Dr. Brian Jackson at the Horticultural Substrates Laboratory, NC State Raleigh, to analyze western species—most notably Ponderosa pine—and confirm their compatibility and performance as engineered potting substrate (Figure 1.5). That scientific validation underpins the company’s credibility with conservative horticultural buyers.

Figure 1.5:North Carolina State students working with wood chip samples from Plumas Wood Fiber.

Public and philanthropic support funded early study and piloting activities: the California Department of Forestry and Fire Protection (CAL FIRE), the Plumas County Fire Safe Council, and the USDA Forest Service provided grants for a feasibility study and pre‑construction planning. Earlier this year, a Conservation X Labs Fire Grand Challenge award enabled a pilot collaboration between Plumas Wood Fiber and the Real Good Soil, which included procurement of a hammer mill to process Ponderosa pine chips into trial fiber that has recently been distributed to some 20 nurseries, academic institutions, and other horticulture industry stakeholders for growth studies.

Additionally, Real Good Soil, founded by Joel White, partnered with Plumas Wood Fiber to provide operational support during the pilot, offering feedstock sourcing, heavy‑equipment handling, and onsite space that removed critical logistical barriers to testing. Real Good Soil’s contribution accelerated sample production and distribution to industry partners while illustrating how local operational capacity can de‑risk early-stage biomass processing.

Going forward, operational partnerships will be critical to Plumas Wood Fiber’s success: supply contracts and working relationships with forest contractors and public fuels programs will be necessary to secure steady volumes of chips and help manage seasonality, while early offtake discussions and letters of support from nurseries and soil‑blend companies identify clear commercial pathways. Similarly, strong financial partnerships—grants, impact finance, and public loan programs—will be key to assembling the capital stack needed for commercial operations. These collaborative relationships—scientific, operational, and financial—form the backbone of Plumas Wood Fiber’s approach to turning excess forest biomass into a market‑ready, peat‑free substrate.

1.6Impacts¶

Due to its environmental and community approach, Plumas Wood Fiber’s project will have multiple positive environmental and social impacts both environmental and social. These are explored in the next two sections.

Environmental¶

Plumas Wood Fiber’s products provide multiple environmental benefits, beginning with their potential to reduce reliance on peat—a material whose extraction damages sensitive peatland ecosystems. Canada currently extracts and exports approximately 1.3 million tons of peat each year. Once removed from its native bog environment, where it serves as a long-term carbon sink, peat gradually biodegrades and releases carbon into the atmosphere that would otherwise remain sequestered. While wood fiber substrates also biodegrade, they are derived from renewable biomass already circulating within the active carbon cycle rather than sourced from a permanent carbon reservoir, making them a more climate-aligned alternative for horticultural and industrial use. Moreover, producing wood fiber substrate regionally avoids the emissions associated with long-distance peat imports, further reducing the product’s carbon footprint.

Plumas Wood Fiber’s model repurposes excess biomass from preventative fuel reduction and post-fire salvaging projects—material that might otherwise be burned, left to decay, or used in low-value energy applications—into a soil-enhancing product that temporarily stores carbon and improves plant-growing media. Commercial-scale substrate production supports wildfire mitigation and recovery by creating consistent market demand for biomass generated through fuels treatments and salvage harvesting. This demand can help finance additional forest management activities and incentivize contractor capacity to scale up forest-thinning and salvage operations. Under the planned facility configuration (two extruders operating on double shifts), Plumas Wood Fiber estimates it will utilize approximately 10,000 bone dry tons (BDT) of chips annually. While carbon accounting depends on variables such as avoided combustion, decomposition rates, and soil carbon dynamics, this volume represents a meaningful contribution to carbon management at the facility level.

Figure 1.6:Wood fiber storage bunker in the Netherlands.

Social¶

Establishing a commercial facility will generate local employment in production, logistics, and administration, while advancing economic development strategies in Plumas County—particularly those aligned with post-wildfire recovery efforts (Figure 1.6). Plumas Wood Fiber estimates that a facility operating under a double-shift configuration would employ six full-time equivalent staff to manage mill operations, bagging systems, marketing and administrative functions, coordination of wood chip deliveries, and outbound shipping of finished products.

Beyond direct employment, the company anticipates that scalable operations will support more stable, year-round job opportunities within the rural economy. Additional workforce demand is expected among forest-based contractors engaged in biomass removal, as the facility creates new market incentives to chip and transport material. By providing a reliable destination for excess biomass, the facility transforms a disposal challenge into a catalyst for economic activity—linking forest restoration to job creation and regional resilience.

1.7Lessons¶

Plumas Wood Fiber demonstrates how an integrated, regionally focused approach can turn a forest-management liability into an economic and environmental asset. Important lessons from the company’s pilot phase include:

Simultaneously addressing societal/environmental problems and industry needs makes for a compelling case to governments, grantmakers, and impact investors.

Grants and partnerships are essential to offset business risk, especially when resources are constrained.

Strong academic collaboration and rigorous lab testing are necessary to validate product performance.

Broad outreach and participatory validation help to generate interest and move potential buyers from curiosity to commitment.

Bridging the capital and operational gap between pilot-scale and commercial-scale production requires strategic planning, e.g., co‑locating with energy partners and securing early letters of intent from offtake partners to reduce investment risk and smooth early cash flow.

1.8Innovation¶

Plumas Wood Fiber has proven the technical and commercial potential of converting excess forest biomass into a market‑ready, peat‑free substrate, with partnerships and pilot results providing a credible path to scale. Achieving commercial success will depend on securing contractable chip volumes, reliable low‑cost energy through strategic co‑location, continued trial replication to win conservative buyers, and timely access to blended capital. With those elements aligned, Plumas Wood Fiber can deliver a regional, climate‑positive alternative to peat that strengthens forest health, supports local economies, and meets growing demand from the horticulture sector.

1.9Credits¶

We recognize and celebrate the innovation and leadership of Plumas Wood Fiber for advancing a practical, circular solution that converts excess forest biomass into a high‑quality, peat‑free horticultural substrate while strengthening regional wildfire resilience. We also extend our deep gratitude to CALFIRE’s Business and Workforce Development Program for funding the Forest Business Alliance’s work with Plumas Wood Fiber, Real Good Soil, and other community forestry partners across California. Rural and Tribal communities engaged in the forest products sector can benefit from resources, such as the Forest Business Alliance Guidebook, the Forest Business Alliance website, and upcoming Forest Business Alliance workshops.

Unless indicated, all photos in figures by Jeff Greef.